Is the Problem Your Trying to Solve also an Opportunity

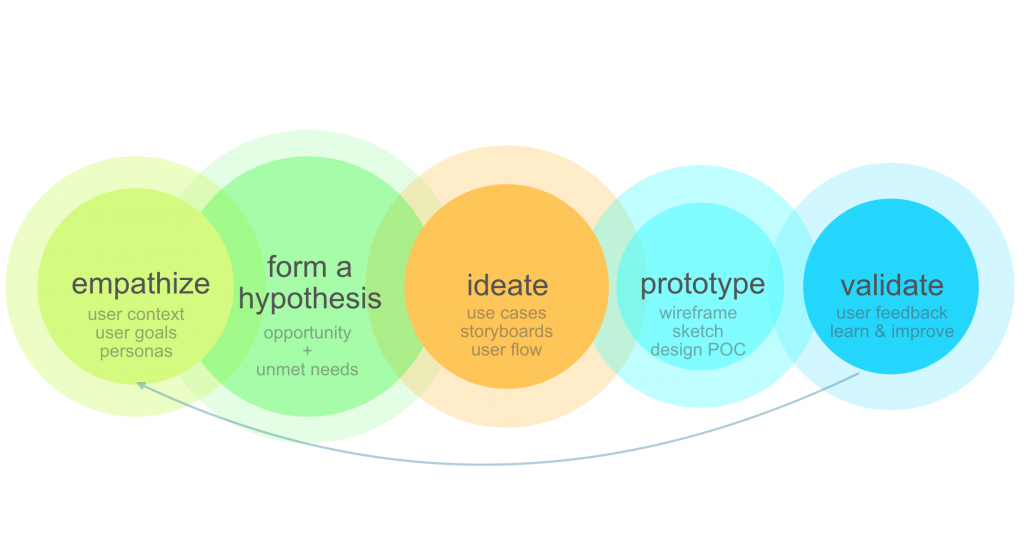

It might sound obvious, but when you’re in the discovery and early definition phase and considering developing a prototype to test or a product solution it’s critical to understand the problem you’re trying to solve. However it’s common that this is often given to designers filtered down from executives through managers under pressure to meet a deadline. This often sacrifices research and the chance to do design exploration which can distancce the designer from understanding the context of the problem.

If at all possible UX should take the bandwidth needed to critically evaluate the problem statement and the data surrounding it from multiple angles. This is true whether we’re talking about a new feature, an upgrade, or an entirely new product. If you can, compare multiple sources and evaluate the themes. Lean in to the experience and look for opportunities to converge technology, innovate or remove steps in the process and look for white space in the market.

It might be cliche by now, but worth repeating here, “take the time to ask why 5 times”, why would a user take that action, why are they concerned about the outcome, why is that important and so on.

As an example consider a scenario where you want to improve your navigation or a user flow. Your analytics might show that the majority of customers who follow a certain path tend to convert, or abandon rates are high in a certain area during a session. This might lead you to presume that you should elevate a navigation label in your taxonomy, or do away with a label because it’s not working. The problem with using only the quantitative data is that it doesn’t tell you “why the customer selected that item, or what they expected to find”. The question that this brings forward for me is to ask “what is the customer’s motivation? why are they trying to solve their problem with your product?”.

You could formulate two hypothesis here, one is that a percentage of people who follow this navigation path identify with the labeling and find what they are expecting, the other would be that the percentage who abandon are either confused, looking for something else or not ready to buy. You could test this hypothesis with a follow up survey to those who do convert, to which I’d also suggest in person interviews (phone calls and skype are fine) with a handful of survey respondents to get better insight.

Put in Time to Observe and Listen

On the other hand, getting feedback from those who abandon is much more difficult, their time is valuable and they have no incentive to invest in your service or solution if their perception is that it’s not for them. However, this insight is incredibly valuable for you as your goal is likely to increase your reach and sell more products. Some of the tactics you might consider are Intercepts, A/B/n tests, landscape study or sentiment analysis in forums or customer reviews, (people who have a bad experience are often likely to leave a review). You might need to enlist a paid service to find and screen candidates that match a profile of your target customer and then offer some sort of compensation for their time. Personally I prefer the in person interview approach as it allows for much better insight in a conversational way. If you have a customer service department meet with them and get their feedback as well, your top 10 trouble tickets or customer complaints are a wealth of knowledge.

As you review your inputs this should lead you to consider the question what is the unmet need, is there an opportunity to exceed expectations? By observing and evaluating customer behavior or reading between the lines during in person interviews (what people say they do, actually do, or would do are often different things). You can start to get a sense of what their motivation is. Tapping into the emotional drive and motivation of your audience is where opportunities lie. You have table stakes in the form of experience parity that people are use to from other products in the market. Consider what those are and how to exceed expectations while doing the essentials well to help you differentiate.

Even if you have put all of the information in front of them, the buy-button may literally be on the page, it may not be enough. Visual design, copy and layout are incredibly important. If it doesn’t speak to them in a way that aligns with how they perceive their desired outcome or their status, habit or routine improving then you’re likely to miss out.

Qualitative, Quantitative and Landscape Analysis

The goal here is to have a good profile for the target audience that identifies their wants and needs and outlines the market segments we’re talking to. At the very least the segmentation profiles should cover your markets and industries, available market share and competition. We want to establish a clear, tangible and relevant platform for engagement with our audience. This should be built on or influence our pillars: Product Pillars, Experience Pillars and our Value Pillars, this will then become the filter for how we talk about our product solution and design.

Depending on where you are in your products maturity you might have different levels of depth in the data you have available. Here’s a quick overview of things that I’m looking for as a UX person with different types of data collection.

Qualitative Data

I’m looking for subjective insight here that helps me understand what a customer expects and how what they experience aligns with those expectations. How satisfied are they with it, what is their perception and what words do they use to describe it (e.g. premium, cheap, fantastic, clever or fun). My version of a net promoter score here is to ask the question “what makes this viral?”, essentially what would a person care to share about this with someone else, what does their instagram caption look like.

Methods: contextual inquiry, observation, ethnographic study, segmentation profiles, in person interview, satisfaction survey, real world intercepts, sentiment analysis of customer feedback (think yelp, amazon, your forums or the app store)

Quantitative Data

I’m looking for the numbers to tell me a story. Assuming we have an analytics dashboard where we can see our traffic patterns, some light cohort analysis, and some basic funnels defined or campaigns to track against are a great starting point.

Methods: Analytics Dashboards, Business Intelligence, Funnels & Campaign Metrics, CRM, e-marketing, event tracking, task flow or time to task completion, latency and load time, polls and surveys, likert scale questionnaires, segmentation screeners etc..

Landscape Audit and Table Stakes

It goes without saying that understanding your competition, where they fit in and how they perform is important. A good heuristic review of features and functionality of competitors is incredibly valuable. A landscape audit should also include an evaluation of brand positioning, marketing, headlines and copy, ratings and reviews and evaluation of UX. Once you have an overview you might want to use a rating scale to evaluate how well each competitor executes or prioritizes the feature / functionality.

Methods: Scrape their site, download their app, demo their product, read their reviews, do whatever you can to immerse yourself in the breadth of their offerings

Questions You Should be Asking Yourself

- How did I come to the conclusion that the work I am doing is the work I should be doing?

- For whom does this create the most value (who else)?

- How does this solution meet that need?

- What is the insight that led me to this decision?

- What alternatives did I consider?

- What is the magic moment, what actions bring a smile to the customer’s face?

- What is the metric I am trying to drive?

- Do I have a benchmark?

- What does success look like?

Experiments for Flipping the Script to Identify Opportunities

At this point we’ve been moving a pretty straight line, following a general methodology for validating our strategy and tactics. Let’s take another opportunity to diverge and go wide with our thinking. Really challenge yourself to focus in on what you know about the motivation of your customer and look at the experience from another angle. Disrupt yourself, if not its a pretty sure bet that a startup somewhere is going to do it for you.

- Look to evaluate anything in the experience that can be automated

- Audit user flows for steps or required user input that can be inferred or suggested

- Looking holistically at the experience, can you change the business model (what’s your version of airbnb or uber, VIP or a valet service for example)

- If you can try to elevate the social, emotional or personal status to be gained by the experience

- Tap into the crowd and motivated followers and consider an incentive competition (what’s your version of x-prize, or the netflix challenge)

- You might find white space or a new product opportunity by finding the answer to what helps your customer sleep better at night, or inspires them to wake up in the morning

Of course this is a short list of jump of points, but think about what applies to your industry and Disrupt Yourself before someone else does, and don’t forget to test these ideas in a light weight, design sprint fashion of course before going all-in.

The UX Building Blocks of a User Story

When it comes time to structure your findings and features in a way that can be ready for development and present this to the team here is an outline that I typically follow. It’s common that you’re not able to realize the full vision on the first go so this is where its important to break it down into building blocks that you can tackle in stages–while not losing sight of the vision. Sharing your vision with the team so they can see a little ways out on the horizon and keeping your eye on the prize are definitely important (get to know what motivates the team and tap into that to rally for morale).

As agile development teams are doing their best to run in sprints, deliver MMFs as part of the MVP or continuously deploy and integrate, UX faces the challenge of providing assets and direction that will support this sprint while not reinventing the design or layout down the road. The UX architecture and layout are essential, think of it as the foundation of the house. Try to get these in place in order to help reinforce the mental model of the user and help them understand the experience–use empty states or message appropriately and you can layer in the experience as it evolves.

- UX Demo: this might be at sprint kick-off and should cover some of the context and feedback from testing and a brief demo of the prototype

- What is the unmet need: for example user feedback and testing have shown that updating photos in my gallery is desirable, but the steps to manage the gallery are unclear

- Why will users love this feature

- How will users find this feature: in what section of the site or app, is there a specific mode, will there be a tool-tip or modal dialogue

- What might future versions of this feature include

- What are the UX acceptance criteria

- Prioritized ranking of functionality (must, should, could, won’t)